Financial debt Support Protection Percentage (DSCR) financial loans tend to be specific lending options which are frequently employed by traders within property as well as companies. These types of financial loans tend to be distinctively organised in order to prioritize the actual borrower’s earnings in accordance with their own current financial debt responsibilities. DSCR financial loans tend to be appealing to individuals trying to increase their own portfolios or even handle continuing tasks, because they supply funding in line with the applicant’s income instead of conventional earnings paperwork.

Knowing your debt Support Protection Percentage (DSCR)

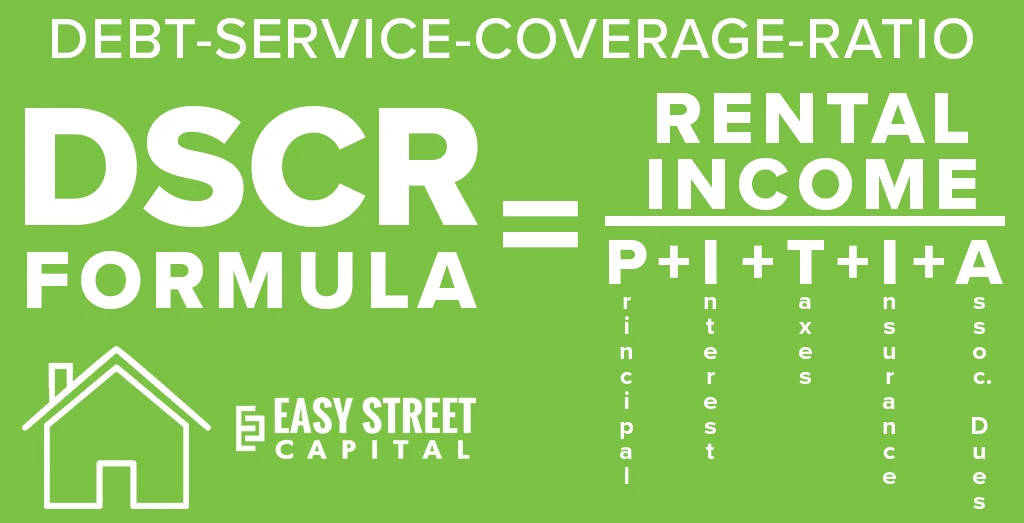

Your debt Support Protection Percentage is really a monetary metric utilized by loan companies in order to evaluate the borrower’s capability to pay back financial debt. It’s determined through separating the actual borrower’s internet working earnings through their own complete financial debt responsibilities. The end result, symbolized like a percentage, offers understanding to the borrower’s monetary wellness. For example, the DSCR of just one. twenty five signifies how the customer offers 25% more money compared to their own financial debt needs, that is usually a suitable border for a lot of loan companies.

Regarding DSCR financial loans, loan companies anticipate the actual percentage to become a minimum of 1. 0, and therefore the actual earnings produced is enough to pay for your debt obligations. A greater DSCR percentage usually displays much better monetary balance as well as can lead to much more advantageous mortgage conditions. Nevertheless, with regard to debtors having a reduce DSCR, the probability of being approved for any mortgage might be decreased unless of course the lending company allows particular mitigations or more rates of interest.

Exactly how DSCR Financial loans Function

In contrast to conventional financial loans that What is Dscr Loan need considerable earnings paperwork, DSCR financial loans concentrate on income since the main determinant associated with eligibility. Loan companies evaluate the borrower’s DSCR percentage through examining monetary claims as well as forecasted earnings. This particular versatility advantages self-employed people as well as property traders that might not possess constant month-to-month earnings however perform produce considerable income.

DSCR financial loans in many cases are used in investment, because they permit debtors in order to influence the actual leasing earnings using their qualities in order to be eligible. The money circulation through these types of qualities assists all of them show an adequate DSCR, allowing these phones financial extra opportunities. These types of financial loans additionally provide aggressive rates of interest, because they present less danger with regard to loan companies because of the concentrate on income instead of work background or even individual earnings.

Benefits of DSCR Financial loans

Versatility within Certification

DSCR financial loans offer an option for people along with non-traditional earnings resources, producing all of them obtainable in order to business owners as well as property traders.

Much less Paperwork Needed

Because these types of financial loans depend on income instead of earnings paperwork, these people include less documents needs, streamlining the actual application for the loan procedure.

Possibility of Greater Mortgage Quantities

Debtors along with higher DSCR percentages might be eligible for a bigger mortgage quantities, letting them financial substantial opportunities or even large-scale tasks.

Attract Traders

DSCR financial loans tend to be especially beneficial with regard to home traders, because they may use leasing earnings in order to be eligible as well as possibly increase their own portfolios.

Dangers Related to DSCR Financial loans

Whilst DSCR financial loans provide substantial advantages, they’re not really without having dangers. Debtors along with fluctuating earnings amounts could find this difficult to keep the actual DSCR percentage throughout financial downturns. Furthermore, simply because these types of financial loans concentrate on income, there might be stress upon debtors to keep constant leasing or even company earnings. The short-term decrease within earnings make a difference the actual DSCR percentage, possibly resulting in issues within mortgage payments.

That Should think about the DSCR Mortgage?

DSCR financial loans tend to be ideal with regard to property traders, self-employed people, as well as business people. This particular mortgage kind is fantastic for people who produce considerable income through opportunities however might not possess traditional work earnings. Debtors within these types of groups frequently think it is difficult in order to be eligible for a conventional financial loans because of fluctuating earnings channels, producing DSCR financial loans an attractive choice.

Traders seeking to increase their own property holdings or even financial big tasks frequently depend on DSCR financial loans. These types of financial loans permit them in order to influence their own present income in order to safe funding without having considerable earnings paperwork. With regard to business people that prioritize development, DSCR financial loans provide a versatile answer which aligns using their money flow-centric monetary information.

Summary

To sum up, DSCR financial loans really are a useful device with regard to debtors that produce constant income through opportunities or even companies. Through concentrating on your debt support protection percentage, loan companies measure the borrower’s capability to handle financial debt via earnings instead of traditional work paperwork. Along with versatile certification requirements as well as less paperwork needs, DSCR financial loans tend to be a stylish choice with regard to property traders as well as self-employed people.

Whilst DSCR financial loans provide significant advantages, these people include dangers, particularly within fluctuating earnings situations. For all those along with constant leasing earnings or even constant income, nevertheless, these types of financial loans give a useful as well as effective funding answer.